Lyft is preparing for robotaxis, not car rentals.

- Lyft is launching a car rental service that I think has nothing to do with renting cars and everything to do with working out to successfully run a fleet of robotaxis.

- Lyft has launched a car rental service from within its app which has sent Hertz and Avis shares into a tail-spin, but in reality, is not going to cause them any immediate problems.

- This is for two reasons:

- First: capital intensity: Building a rental vehicle fleet from scratch is a very capital intensive business.

- Hertz has $18.6bn of vehicles on its balance sheet and spends well over $7bn a year on buying new ones (net of vehicle sales).

- By contrast, Lyft has only $3bn on its balance sheet and is barely break-even on a cash flow from operations perspective.

- This means that there is no way that Lyft can offer anything more than a small annoyance to the big vehicle rental companies when it comes to damaging their business.

- However, what it can do is show-up the poor user experience and poor value offered by many of the rental companies which may trigger some change within the industry.

- Second, robotaxis: This move by Lyft is not about entering the vehicle rental industry but should be seen as an experiment.

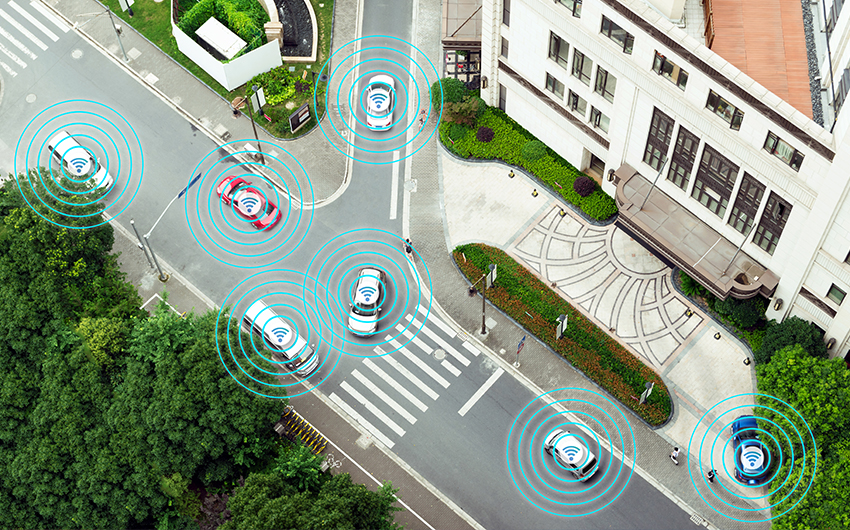

- Lyft is testing how it will manage its robotaxi fleet when they are finally ready to hit the market.

- This is where all of the ride-hailing companies must eventually go as their existence as marketplaces are no longer viable once the supply side of the market (drivers) has been removed.

- Their only real option is to take over the supply side of the marketplace and become providers of a transportation service.

- The platforms that they have built to manage the logistics of drivers and riders should be fairly easy to migrate to this new reality but it is the nuts and bolts of managing these assets where the difficulty will lie.

- Hence, this experiment is more about learning how to manage a fleet of moving assets than it is about having a go at the vehicle rental industry.

- Hence, I think that the knee jerk response in the shares of Hertz and Avis will soon be corrected once anyone with a pocket calculator works out that Lyft does not have the financial clout to make a dent in their businesses.

- Lyft also has quite a long time to get this right as I continue to think that the combination of technical challenges and the vehicle insurance industry will prevent autonomous vehicles from becoming a commercial reality before 2028.

- By this time, I also expect that the taxi industry, the vehicle rental industry and the ride-hailing industry will have essentially become one.

- There will be a lot of fall-out on the way.