Jensen will not be losing much sleep yet.

- AMD has unveiled a fearsome competitor to Nvidia’s H100 and H200 series but does not seem to have realised that the way to beat Nvidia is to create a software development platform that is better than CUDA.

- Fortunately for AMD and the rest of the AI-training chip wannabes, the emerging AI ecosystems may do for them that which they are unlikely to be able to do for themselves.

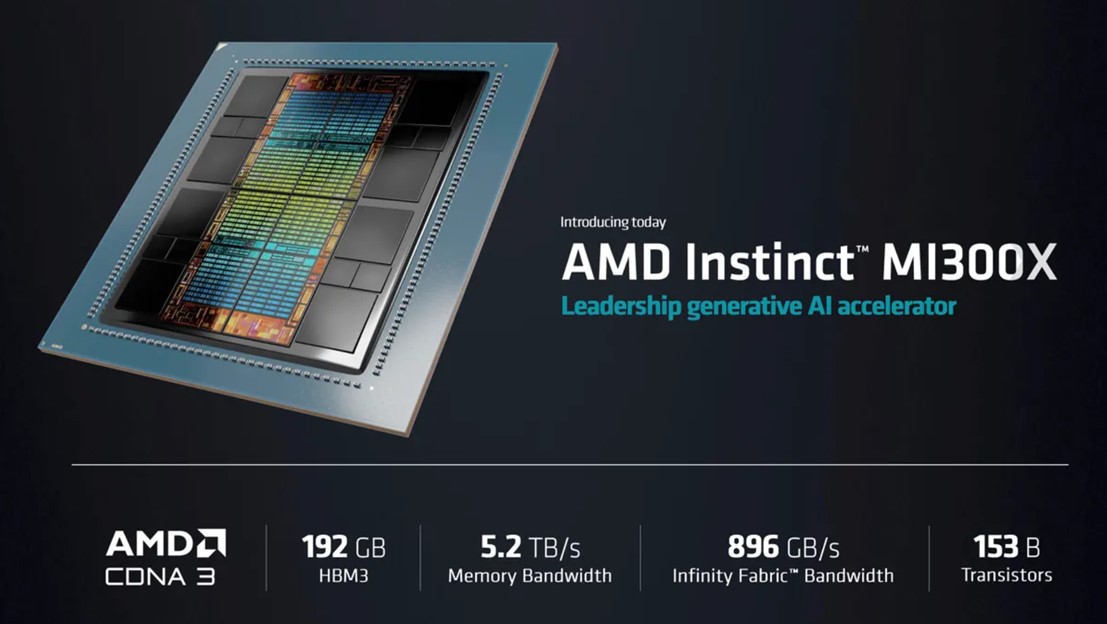

- AMD has launched its new MI300X AI training chip which it claims is the “most advanced AI accelerator in the industry” and increased its forecast for the AI processor market from $150bn in 2027 to a ludicrous $400bn.

- This forecast obviously excludes the impact of any bursting of the AI bubble and assumes that the frenzy that we have seen in 2023 will carry on indefinitely.

- Frenzies, like the one we are currently experiencing, have always come to an end as the inevitability of reality begins to have an impact. (Internet bubble, autonomous driving, The Metaverse)

- On its hardware specification, the MI300X comfortably beats the H100 meaning that against the newly launched H200, it is probably on par.

- However, in my opinion, the hardware performance is almost irrelevant and as long as Nvidia is at least as good as the best of the rest, no one is going to lay a finger on it without outside help or doing something about software.

- This is because Nvidia’s magic is not its ability to design good chips (which it does) but its creation, development and constant evolution of the CUDA platform.

- CUDA is over 20 years old and was first developed as a way to enable general computing on massively parallel graphics processors.

- Then in 2012, it became the standard platform for the development of neural networks when the algorithm that solved the ImageNet database was created.

- One could argue that Nvidia got lucky as it just so happens that massively parallel GPUs are ideal for training neural networks, but Nvidia did not rest on its laurels.

- Instead, it put a huge amount of effort into ensuring the CUDA was the best platform with the widest range of tools and the best support.

- The net result is that CUDA is now the gold standard for AI development and because it only runs on Nvidia chips, Nvidia has 85%+ market share and 70%+ gross margins.

- In many ways, Nvidia is like Apple which has the ecosystem that everyone wants to use and monetises that ecosystem through hardware sales as the iOS ecosystem is only available on Apple hardware.

- Consequently, it is not until CUDA’s grip on the development of algorithms is broken, is anyone else likely to make much headway in taking share from Nvidia.

- This means that touting hardware bells and whistles is not going to count for very much and AMD had very little to say how it was going to break CUDA’s grip on AI developers.

- However, the likes of OpenAI, Google, and Meta may provide AMD and other competitors with a leg up by shifting the control point of AI development further up through the technology stack.

- OpenAI has already made its play in this direction (see here) and I am certain that Google and Meta will follow in its footsteps as the next great ecosystem bunfight begins.

- These companies will all provide software kits (SDK) that will enable developers to create algorithms by fine-tuning the ecosystem’s foundation models to a specific task.

- If this becomes extremely popular, then there is a risk that the control point shifts away from chip development platforms further up through the stack.

- These ecosystems have every incentive to broaden silicon support for their ecosystems and will try and abstract development away from Nvidia’s control point.

- This is exactly what happened in smartphones and the hallmarks of the AI ecosystem look very familiar to what happened in 2010 and beyond.

- However, this is going to take some time and so for the next year or more, Nvidia is in a very strong position and both its share and its gross margins will be unchallenged.

- Nvidia remains priced for perfection but while it continues to blow expectations out of the water, its valuation is likely to hold.

- I continue to think that there are better places to look in the technology sector on a growth to valuation perspective.