Google throws down the gauntlet to HERE and TomTom.

- The arrival of Android Automotive into the vehicle in the volume segment (Renault-Nissan-Mitsubishi) is a watershed moment for the automotive mapping industry as I think that it must now prove why Google Maps is not good enough for vehicle-based navigation.

- Today, there are really only two viable contenders to supply a map to a vehicle on a worldwide basis.

- These are HERE and TomTom who both have sizable legacy businesses in supplying this data to the automotive industry.

- In Q2 18 TomTom generated €62.6m from the industry upon which it made a very healthy 25% operating margin (together with €30m in revenues from enterprises).

- Assuming that TomTom has 20% share of this market, this would imply that HERE (which has the rest) generated revenues of around €240mm in Q2 18, giving an annual run rate of roughly €960bn ($1.1bn)

- If I take the global market of around 93m vehicles and take out China and Japan (who use their own maps), I get a global market of roughly 60m vehicles from which the map providers make about $1.4bn in revenues or $23.3 per vehicle sold.

- I think that this business model has been sustained by two factors:

- First, Automotive grade: Both TomTom and HERE have been considered by the industry for many years to be the only providers of maps reliable enough for vehicle navigation.

- If the user drives into a ditch in the countryside because the navigation system told him to, then the car maker has a significant problem.

- HERE and TomTom have always been able to make that guarantee of quality and historically, they have been better than the Google Map particularly outside of urban areas.

- This has meant that automakers, who are severely constrained by safety and reliability, have been unable to consider Google as an alternative.

- Second, infotainment: Until now, Google has had no presence in the infotainment unit and so automakers have never been in a position to even consider it.

- Google Maps via Android Auto is simply maps running on the smartphone being projected onto the infotainment unit screen and therefore has nothing to do with the vehicle maker.

- Hence, if the user crashes because of a glitch in Google Maps running on Android Auto, liability remains with the user.

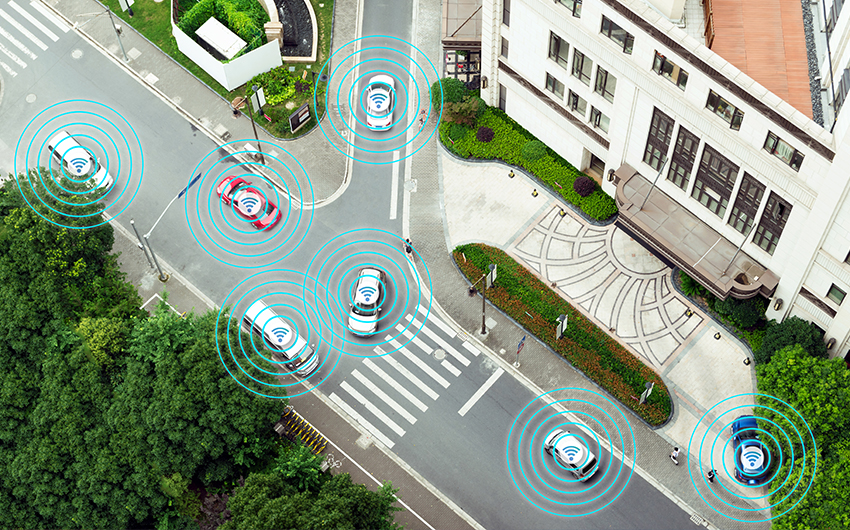

- Furthermore, Google Maps requires connectivity which many cars today still do not have, obviating its use in the mainstream. (This is easily fixable).

- I think these two factors have kept this business model isolated from having to really compete with Google, but with the alliance (which ships 10.5m units or 11.3% of all vehicles) putting Google in its infotainment units, these barriers can be called into question.

- The big question is whether Google Maps is good enough to be considered automotive grade?

- If it is, then why would an automaker pay $28.6 per unit when it can get an equivalent quality map from Google for $0.

- Obviously, getting the Google Map into the dash for $0 means doing a deal with Google for Android Automotive which I have already called out as extremely risky (see here), but even with that, there is still scope for serious price erosion.

- Taking Android Automotive makes Google Maps available in the infotainment unit but the OEM is not locked into it.

- For example, Audi is still using HERE maps in the Q8 which will have Android Automotive at some point, and I suspect the same will be true for both the alliance and Volvo.

- However, the challenge to TomTom and HERE is to prove how their maps are automotive grade and Google’s is not.

- Failure to clearly demonstrate this fact will lead to every sales rep being asked at every meeting: “Why am I paying millions of dollars for your map when I can get the same from Google for free?”.

- This can only result in substantial price erosion and real problems for both HERE and TomTom.

- From my perspective, the jury is out.

- I have used Google Maps to navigate extensively across the world over the last few years, and apart from a few minor errors and a major slip-up involving a US army base in San Diego, it works extremely well.

- Hence for me, it would appear to be good enough.

- This is the challenge that Google is now making to the mapping companies and the ball is firmly in their court.

- They need to step up as scepticism in the market, (TomTom shares down 24% since the announcement) and among their competitors is now high.

Blog Comments

Peter

September 21, 2018 at 10:08 pm

OEM’s will continue to use HERE or TomTom because otherwise you would require the car to be always online, including data plan. The onboard map will be either the main map or the fallback map, depending on which navigation he prefers. A branded navigation experiece in the car is a huge plus in terms of appearance, the $25 is easily worth the cost. In my book the price is around $50 though. TomTom has customers signed (including large unknown US OEM) for hybrid maps. On board with realtime updates through cloud.

RICHARD WINDSOR

September 23, 2018 at 5:50 pm

Hi Peter. There is no technical reason why Google Maps cannot be downloaded to the vehicle. Its been a preference of Googe’s because traffic = money for Google as the map is free. This is why it demands that the device be online all the time. In fact you can download portions of Google Maps to a device for offline usage. The figure of $25 is my estimate of total map revs divided by cars shipped. Pretty sure there will be volume discounts.